How to Make Money with Only Plans

James Arthur Baldwin made this canny observation about money: “Money…was exactly like sex, you thought of nothing else if you didn’t have it and thought of other things if you did.” Strangely, we live in a time where people are more forthcoming about their preferred sexual positions than their actual financial position.

There are many reasons for this, but much like sex, social media has warped our expectations and outlier behaviour has entered the mainstream. When some feel pressurised into depicting lavish lifestyles online, everyone else looks and thinks what am I doing wrong?

The answer is – sorry to disappoint – probably nothing. Unless you want to beat yourself up for not having been adopted by Lionel Richie as a child, do not get seduced by the industrial effort that goes into depicting a glamorous lifestyle. Generally, they’re just trying to sell you something.

However, when it gets dangerous is when people tell you that you too can achieve this lifestyle if you “Buy this new hamster themed crypto/ try forex trading/ have a go at online gambling”. Even anecdotally, people who I know struggle to pay rent put their money into cryptocurrencies they do not understand.

This, and perhaps the fact that I have a visceral dislike for anyone proposing a get rich quick scheme, inspired me to write a decidedly unsexy guide on how to make the most of your money:

1. Keep track of your spending

As my mother says – a penny saved is a penny earned.

The only way to assess what you can afford to save, invest, and spend is keeping on top of what comes in and out.

One of the best suggestions I’ve heard is an aggregate spreadsheet which you update with different colours for different types of expenses.

What is necessary and what is extravagant will look very different depending on your financial position.

I am not here to judge what you can spend or save. The only thing I will say is the one thing you cannot abdicate responsibility for is your own finances.

2. Never put all your eggs in one basket

I just read two excellent books on scams. They are The Missing Crypto Queen by Jamie Bartlett and Crypto Wars by Erica Stanford.

Both feature people whose net worth was wiped out overnight for one reason – they bet everything they had.

No matter how good something looks, make sure your money is not just in one place.

Daniel Crosby says get rich quick and get poor quick are two sides of the same coin.

3. Embrace paranoia

The CEO of Intel Andy Grove famously said this:

“Success breeds complacency. Complacency breeds failure. Only the paranoid survive.”

Even when you have money, it can be easy to lose it.

Nothing demonstrates this better than this facts from Morgan Housel’s “The Psychology of Money”.

40% of companies successful enough to become publicly traded lost effectively all their value over time.

The pandemic has proven one thing, unexpected events happen with alarming frequency. If you can, have a rainy day fund.

4. Know thyself

There are only two jobs where there is no threat to your employment if you’re completely wrong – weatherman and economist.

Psychologists and economists have documented 117 biases capable of obscuring lucid financial decision-making.

This is something to bear in mind next time you choose to invest.

Unless you are a medium, in which case you will already know some good lottery numbers, you are just as susceptible to biases as the next person.

Hilariously, Fidelity did a study of their highest performing investments and those that performed best were the ones from the people that forgot they had an account at Fidelity.

If you make a financial decision prepare to win some and lose some.

5. Never underestimate the power of compounding

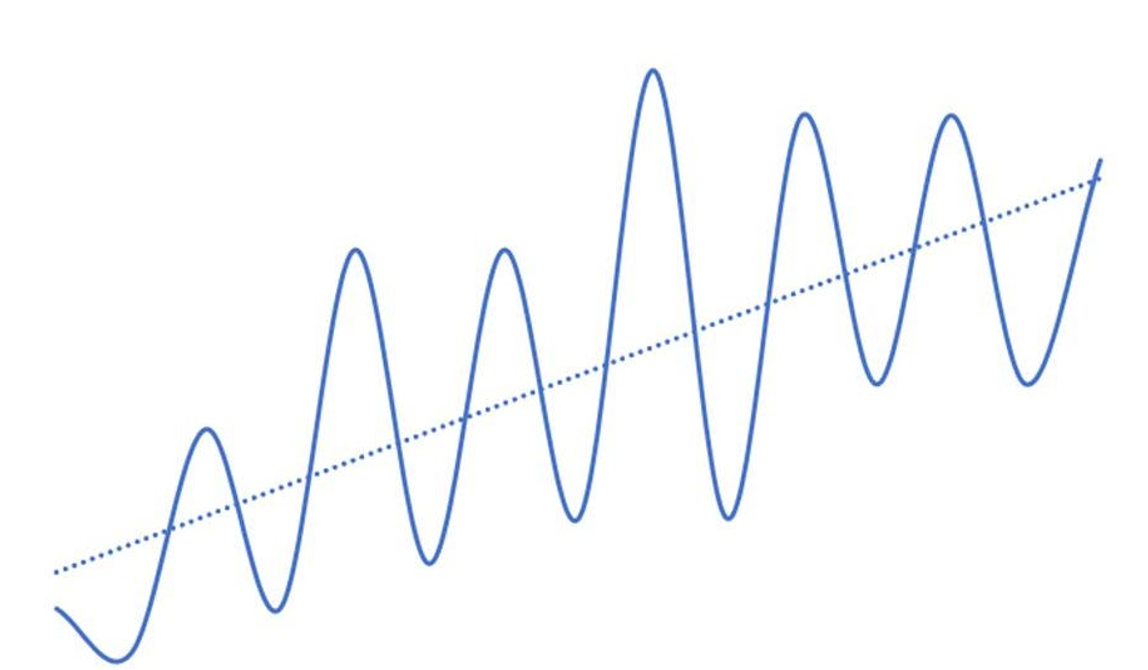

James Clear in Atomic Habits vividly demonstrates the power of compounding.

His personal development advice is that by focusing on “small wins” exponential growth occurs.

If you improve at one thing 1% every day, you’re 37 times better that year.

However, when it comes to financial returns the results are even more vivid.

Warren Buffett has been investing since he was 10 years old and of his over $96.7 billion net worth over $81.5 billion came after his 65th birthday.

To conclude, making money and losing money are an inevitable part of life, but much like the rest of social media a lot of what you see is an edited highlight reel. It’s time we had more candid conversations about how to manage and optimise our finances. As Groucho Marx quipped, while money can't buy happiness, it certainly lets you choose your own form of misery.